ESG

Turning dairy waste into sustainable, renewable natural gas

At the George DeRuyter and Sons Dairy in central Washington,7,000 cows produce a lot of manure — 160,000 …

Environmental, Social & Governance (ESG)

At Williams, we understand the direct link between sustainable business operations, corporate stewardship and long-term financial success. By integrating ESG practices throughout the company and into our everyday operations, we hold ourselves accountable through transparent interactions with customers, employees and shareholders.

Sustainability Governance

ESG-related risks and opportunities closely interact with other business risks. Therefore, Williams believes it is important that we uphold clear and effective expectations for the management and oversight of ESG-related topics. Strong sustainability governance gives Williams management the ability and confidence to proactively mitigate risks and harness opportunities. It also enables us to monitor our positive and negative ESG-related impacts, transparently communicate with stakeholders and accurately measure our ESG performance over time.

Board of Directors Oversight

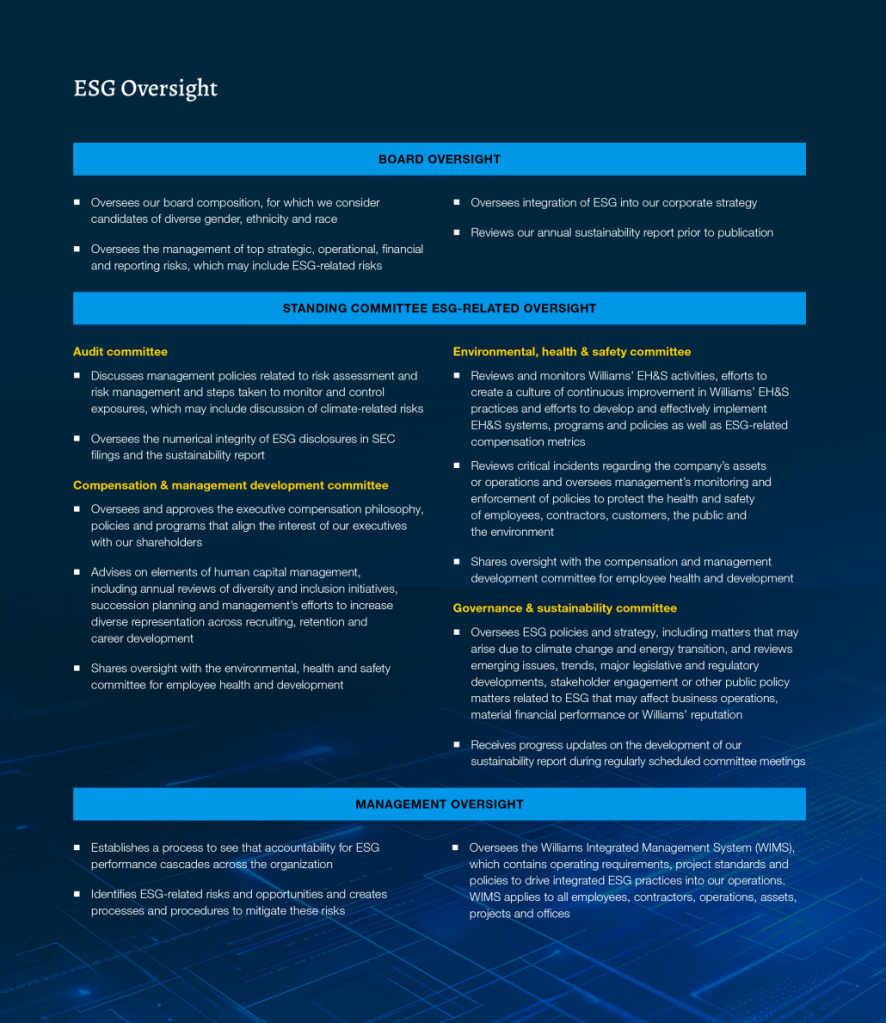

Each of our board committees, as well as the full board, are responsible for overseeing the sustainability of our business and its impacts on the environment and people. Our board may delegate some oversight of ESG to each of its four standing board committees, which consist only of independent directors: audit; compensation and management development; environmental, health and safety; and governance and sustainability.

Our board committee charters clarify committee responsibilities for overseeing climate change-related risks and opportunities, cybersecurity, human capital management and environmental, health and safety. Williams’ Delegation of Authority Policy requires board approval for large projects and mergers and acquisitions with capital expenditures greater than $200 million. When seeking approval, management presents the board with a project overview that includes strategic alignment and any identified project risks, which may include ESG risks and impacts.

Management Oversight

Williams management keeps sustainability and ESG risks and opportunities front of mind as they make decisions regarding strategy, growth, human capital and financial capital allocation. At a management level, our Director of ESG drives execution and is responsible for engaging with Williams’ shareholders to understand ESG expectations and increase the visibility of our performance, including monitoring investor engagement and responding to ESG ratings and rankings organizations. In addition, our ESG Steering Committee supports the development and implementation of cross-functional sustainability initiatives, eliminating blind spots and coordinating resources.

Key ranking groups like Dow Jones Sustainability Index, CDP, Sustainalytics and MSCI are recognizing Williams’ commitment to transparency around environmental, social and governance performance (ESG).

Williams’ score signifies the company is taking coordinated action on climate change.

Williams recently co-led an initiative through the Energy Infrastructure Council (EIC) and GPA Midstream to launch the first-ever Midstream Company ESG Reporting Template. The tool allows midstream energy infrastructure companies to present their sustainability metrics that matter most to investors in a transparent and comparable way.

ESG

At the George DeRuyter and Sons Dairy in central Washington,7,000 cows produce a lot of manure — 160,000 …

Energy & Infrastructure

You may remember from science class that hydrogen is the simplest and most abundant element in the universe. Think …

ESG

Zach Keith was named director of Environmental, Social and Governance (ESG) for Williams in May 2022. He came into …

Stay up to date with the latest news and events